Low Income Taxpayer Clinic (LITC) at New Mexico Legal Aid

The LITC represents and advises low income taxpayers in income tax disputes with the IRS (and in related NM income tax matters). If you have a dispute with the IRS and cannot afford a private attorney, contact us by calling 833-545-4357, or apply online by clicking here.

View the LITC brochures here: in English (2025) and en Español (2025).

What’s New?

See our most recent 2025-2026 Tax Filing and Information Handout

See our 2025 Tax Season Letter [English](.pdf)

Vea nuestra 2025 Carta de Temporada de Impuestos [Spanish](.pdf)

New in 2026: IRS plans to eliminate paper tax refund checks (www.irs.gov/newsroom/irs-to-phase-out-paper-tax-refund-checks-starting-with-individual-taxpayers).

- Taxpayers will need a bank account or other way to receive funds electronically. Taxpayers should make sure they know their banking information or consider opening a free or low-cost account. Consider FDIC: GetBanked, MyCreditUnion.gov, and www.cabq.gov/bank-on-burque for account options.

Upcoming Tax Preparation Educational Workshops:

- TBD - check back in early 2026

-

Tax Preparation Assistance

The Low Income Taxpayer Clinic at NMLA does not generally provide tax return preparation services. If you need tax preparation assistance, please consider the following*:

- Tax Help New Mexico: For those in Central NM, TaxHelpNM will prepare current year and prior year tax returns. They offer free appointments, and limited walk-in service at some locations. Go to www.TaxHelpNM.org or call 211 (or 505-245-1735) for updates or to make an appointment. Note that appointments become available on a rolling basis, so it is important to check back regularly if all appointments appear taken.

- Call AARP Tax Aide at 888-227-7669 or visit http://AARP.info/TaxAideLocator, and make a free in-person appointment (generally during tax season only).

- Free do-it-yourself federal tax filing software is available at www.irs.gov/filing/free-file-do-your-federal-taxes-for-free for those with incomes of $73,000 or less.

- You can file your New Mexico return by using the Taxpayer Access Point system. https://tap.state.nm.us/tap/_.

- Visit www.GetYourRefund.org – If your income is $66,000 or less, use this to get connected to IRS volunteers around the country to have your tax returns prepared online or over the phone.

- Visit www.MyFreeTaxes.com - If your income is $73,000 or less, use this to prepare your own returns with help from IRS certified volunteers if/when you need help. If income $60,000 or below, there is even more help available.

- To find other free tax preparation sites near you, visit https://irs.treasury.gov/freetaxprep.

- If you are unable to find a free tax preparer, consider hiring an Enrolled Agent: call NM Society of Enrolled Agents (NMSEA) at 505-877-1598, or https://nmsea.net, or https://taxexperts.naea.org. Another option is a CPA (Certified Public Accountant): call 505-246-1699, or visit www.nmscpa.org/resources/find-a-cpa.

- Lutheran Family Services (for refugees), 505-933-7032

* Some of the services listed may be available during tax filing season only

-

Application Process

How do I apply? Call 833-545-4357 (toll-free) between 10 am and 3 pm, Monday through Thursday, to schedule a phone intake interview. Or, apply online at www.newmexicolegalaid.org. After you complete the intake interview, our staff will determine whether your eligibility. If accepted, one of our attorneys will reach out to conduct an initial consultation.

What if the LITC will not accept my case?

If the Clinic cannot accept your case, it may attempt to refer you to a practitioner, either an attorney, CPA or enrolled agent, who will handle your case at no cost as a volunteer. The Clinic is not professionally liable for cases it does not accept.

What do I pay?

There is no charge for our services. Generally, the IRS and the U.S. Tax Court will waive or lower fees for low-income taxpayers. You are responsible for any fees charged by the IRS, New Mexico Tax & Rev or the U.S. Tax Court.

Where can I receive services?

The New Mexico Legal Aid Low Income Taxpayer Clinic serves all of New Mexico. During the Covid-19 epidemic, we are working by phone, fax, email and mail, as appropriate. Our physical location is 505 Marquette N.W., Suite 700, in downtown Albuquerque. Our mailing address is NMLA LITC, P.O. Box 25486, Albuquerque, NM 87125-5486.

-

Eligibility

Who is eligible for our services?

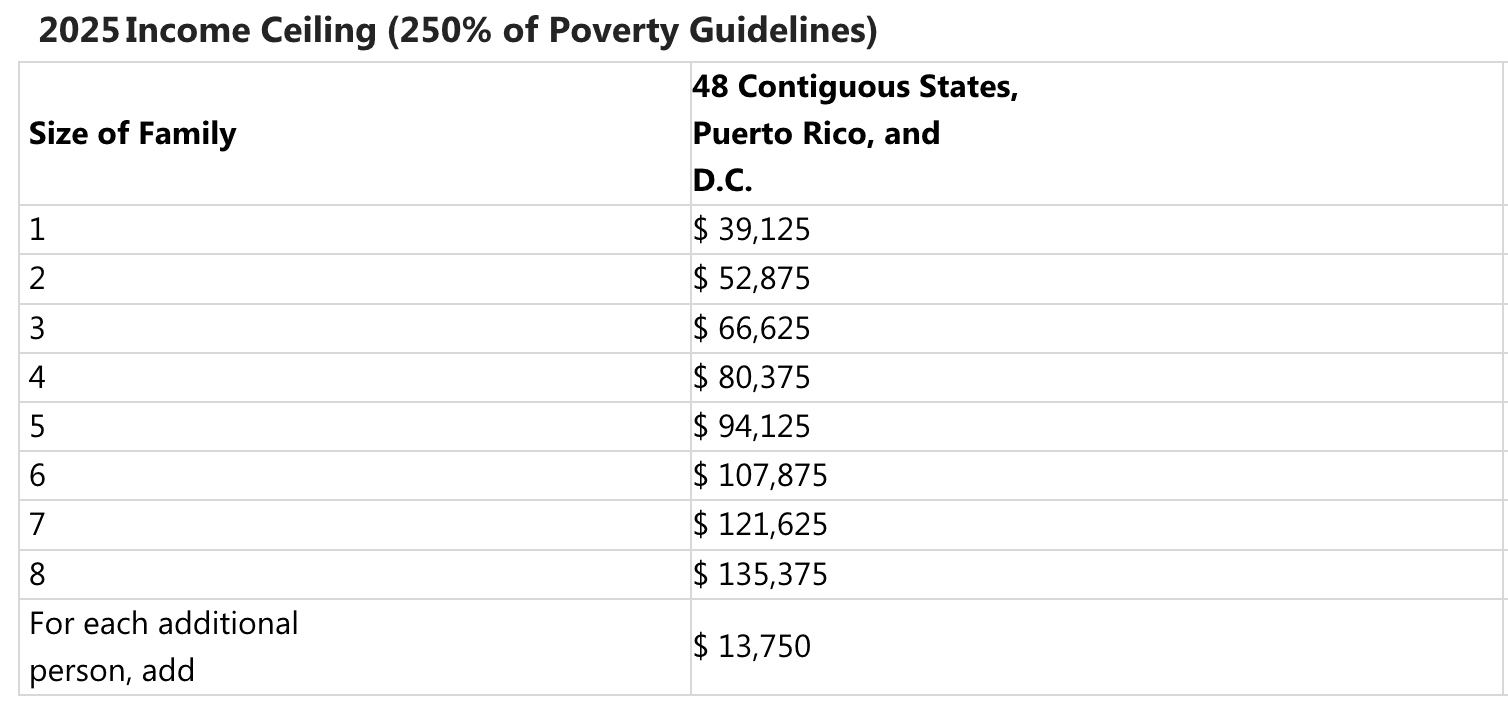

Taxpayers whose total family income is not more than the maximum limit in the chart shown below are eligible. A family unit is either: you and those who live with you; or you alone, if you do not live with someone related by birth, marriage or adoption. Unrelated individuals living together are considered separate “family units.” For any additional family member over eight total, add $11,350 to the maximum yearly income.

2025 Income Ceiling (250% of Poverty Guidelines)

-

2023 Tax Preparation Information:

- 2023 Tax Filing Handout (updated 1/19/2024).

- 2023 Tax Season Letter (updated 11/21/2023).

- Prior Year Tax Preparation: Information on Filing 2022 Taxes after April 18, 2023 (click this link). For our 2022 tax filing handout, click here, and for our 2022 tax filing (2023 tax season) letter, click here.

- Español: Para nuestro folleto de informatión fiscal más reciente en español, haga clic aqui.

-

2022 Tax Preparation Information

Prior year tax filing: Information on Filing 2022 Taxes after April 18, 2023 (click this link). For our 2022 tax filing season handout, click here, and for our 2022 tax season letter, click here.

Know your rights! Conoce tus derechos! View past educational presentations:

- April 11, 2023, 5:00 pm MST. New Mexico Tax Prep Workshop - What to know about filing your 2022 Income Taxes. Watch here (Facebook event link): https://fb.me/e/11duiugeU

- 23 de Marzo, 2023, 6:00 pm MST. Taller de preparación de impuestos de Nuevo México. Conozca las últimas estrategias sobre cómo preparar sus 2022 impuestos. Mira el evento aquí: https://fb.watch/jy_lEMnPN1/

-

Frequently Asked Questions

What is considered a dispute with the IRS?

The following cases constitute a dispute with the IRS and may be matters that the LITC can take on:

- The IRS is asking you to provide support for a deduction or credit claimed on your return

- The IRS has denied a deduction or credit claimed on your return

- The IRS has issued a “Notice of Deficiency” and you have 90 days to petition the U.S. Tax Court

- You can’t pay an existing IRS or New Mexico income tax debt

- You owe income tax for a year in which you were married to an abusive spouse

- You are experiencing tax-related identity theft

- You need help getting your stimulus check

What types of cases will the LITC not accept?

The Clinic only accepts personal income tax cases. It can help a sole proprietorship, but not a partnership or incorporated business. It may be able to help with New Mexico income tax, but only if the state problem is related to a federal income tax issue. The Clinic cannot help with cases that involve only New Mexico gross receipts tax, but we may be able to provide advice or referrals. Although we generally do not prepare income tax forms, we may prepare them in the course of a tax dispute. The Clinic does provide brief consultations. Amounts in dispute generally may not exceed $50,000 (including penalties, but excluding interest) for a single tax year.

What are Clinic hours?

We are working at the office by appointment only. If you need to drop something off, please make arrangements to do so with your assigned attorney.

What will the Clinic ask me to sign?

- A representation agreement that outlines what the Clinic will do for you and explains your rights and responsibilities

- A statement of facts that describes why you are seeking the Clinic’s services

- IRS Form 2848, power of attorney, that allows the Clinic to speak to the IRS on your behalf

- Depending on the circumstances, you may also be asked to sign a declaration of citizenship, a New Mexico Department of Revenue and Taxation Tax Information Authorization and/or a Joint Representation Agreement.

More questions? See the "Other Resources" section of this website.

-

How to Prepare for Your Legal Consultation

If you have received a letter from the IRS or NMTRD:

- Read the letter immediately and note any stated deadlines

- Call IRS or NMTRD if you have any questions

- Learn your rights by reading IRS Publication 1

- Document everything

- NEVER miss a deadline while you are waiting for the Clinic or anyone else to represent you.

Ensure that tax returns for previous years have been filed

Failure to file tax returns for previous years may cause you to incur a penalty, and may lengthen the time it takes for your case to be resolved. For free tax preparation resources, please see the "Tax Preparation Assistance" section of this website.

-

Other Resources

New Mexico Gross Receipts Tax (GRT) Information Sheet (updated 11/8/2024): CLICK HERE

Watch: Tax Season Video Shorts, available to view at the NMLegalAid YouTube channel.

Video Segment descriptions:

- The importance of using a qualified tax preparer

- Dangers of tax refund anticipation loans or advances

- Three pieces of advice about tax season

- Questions to ask your tax preparer

- Some forms to bring to your tax preparer

- More important information to bring to your tax preparer

- How and why to carefully review your tax returns before signing

- What to take with you when you leave the preparer’s office

- How to find free tax preparation services

- What if you receive an unexpected tax bill?

- Special income tax credits

- When to expect your refund

- What to consider when you get your refund.

Read: Full Script for “Be Careful: It’s Tax Season” video series

Archives:

2022 Tax Filing Season Letter (2022 Tax Returns) - “What You Need to Know About Filing Your 2022 Tax Returns”

2021 Tax Filing Season Letter (2021 Tax Returns) - “What You Need to Know About Filing Your 2021 Tax Returns”

Watch: Tax Preparation Workshop Video, “IRS Better Have My Money! 2021 Tax Preparation Workshop,” Recorded April 12, 2022, 5:00 MT: https://fb.me/e/3f9I8ib37

Contact us:

- Nathaniel Puffer (Clinic Director) at 505-814-6593

- Grace Allison at 505-234-3795

- Anne Rothrock at 505-545-8543

- Email: LITC@nmlegalaid.org

Pro Bono — Are you a tax advocate (Attorney, CPA, or EA) and interested in volunteering? We would love your help and participation. Sign up HERE, or contact Nathaniel Puffer, Clinic director.

Click here for Conference Materials